Introduction: transforming tax obligations into growth drivers

Every year, thousands of Quebec companies face the same deadline: filing their corporate income tax returns. For many, this period is synonymous with stress, uncertainty and paperwork. However, when properly managed, the tax return can become a strategic tool.

A practical guide to corporate taxation isn’t about making taxation “fun”, it’s about making it understandable and profitable. Knowing where to look for deductions, how to plan expenses, or how to avoid costly mistakes can have a direct impact on a company’s profitability.

In this article, we’ll look at how to optimize your company’s tax return, covering the essential steps, key optimization principles, available tax credits and best practices for staying compliant… while reducing the bill.

1. Understanding corporate income tax: the basics you need to know

Before diving into optimization, it’s essential to understand how corporate taxation works in Canada and Quebec.

What is corporate income tax?

Corporate income tax is the portion of your taxable profits that your company must pay to the federal and provincial governments.

It is calculated on the basis of net taxable income, i.e. gross income less eligible expenses.

The two levels of taxation

In Canada, companies are subject to two types of tax:

Federal tax (CRA ): administered by the Canada Revenue Agency.

Provincial tax (Revenu Québec): for companies registered in Quebec.

These two administrations require separate declarations, although they are often prepared simultaneously by an accountant.

Corporate tax rates (indicative)

| Type of company | Federal rate | Quebec rate | Approximate combined rate |

|---|---|---|---|

| SMEs eligible for the small business deduction (SBD) | 9% | 3.2% | Approx. 12.2% |

| Ineligible company | 15% | 11.5% | Approx. 26.5% of sales |

These rates may vary by province, industry and applicable tax credits.

2. Key steps to managing your corporate tax return

1. Gather financial documents

First and foremost, you need all the relevant financial information:

Annual financial statements (balance sheet, income statement).

Bank statements and reconciliations.

Register of fixed assets and depreciation.

List of expenses and purchase invoices.

Sales revenue and accounts receivable.

2. Calculate taxable income

Taxable income is your company’s net profit after deducting eligible expenses (salaries, rent, depreciation, etc.).

3. Identify applicable deductions and credits

This is where tax optimization comes in. Companies can take advantage of tax deductions and tax credits to reduce their costs. We’ll take a closer look at these levers below.

4. Filing the tax return

Two main forms:

T2 for federal.

CO-17 for Quebec.

5. Schedule payment or refund

Depending on your instalments, you may have to pay a balance or, on the contrary, obtain a refund.

3. Deductible expenses not to be overlooked

Certain expenses can significantly reduce your taxable income. Here are a few key categories:

Operating expenses

Salaries, benefits and employer contributions.

Commercial rent.

Office supplies, software, telephony, internet.

Maintenance, repairs, insurance.

Travel and entertainment expenses

Business travel (plane, hotel, meals).

Reasonable business-related entertainment expenses.

Capital expenditures

Equipment, vehicles and computer hardware can be depreciated over a number of years through capital cost allowance (CCA).

Training and development expenses

Investing in skills development for your team is often 100% tax-deductible.

4. Tax credits to know for companies in Quebec

Tax credits are powerful levers for optimizing corporate tax returns. Unlike deductions, they directly reduce the tax payable.

Popular tax credits for Quebec SMEs

| Tax credits | Target | Rate / Benefit | Main conditions |

|---|---|---|---|

| SR&ED (Scientific Research and Experimental Development) | Encourage innovation and technological development | Up to 30% of eligible expenses | Documented, eligible research activities |

| On-the-job training tax credit | Encouraging practical training for students | Approximately 24% of eligible salaries | Supervised internships related to field of study |

| Investment credit | To support the purchase of productive equipment | Varies by region | Eligible tangible assets |

| Multimedia production credit | Encouraging digital creation | Up to 37.5 | IT sector, video games, interactive media |

Tips for maximizing your credits

Carefully document your eligible activities.

Consult a professional to check your eligibility.

Don’t overlook specific provincial programs.

5. Tax optimization: best practices

Tax optimization involves using existing laws to legally reduce the amount of tax paid. It is neither evasion nor avoidance, but a sound management strategy.

A few concrete levers

Income splitting: whenever possible, allocate income among shareholders to lower the marginal tax rate.

Incorporation of a management company: useful for tax deferral and investment planning.

Mixed remuneration (salary + dividends): finding the right balance between personal and corporate income.

Expenditure planning: anticipate capital purchases before year-end to maximize deductions.

Loss utilization: carry forward losses from a previous year to reduce future taxable income.

Avoid

Postpone your declaration until the last minute.

Mix personal and business expenses.

Forget instalments.

Underestimating the value of professional support.

6. Compliance and proactive management: avoiding common mistakes

Even a good tax strategy can be compromised by a lack of rigor.

Common reporting errors

Incorrect classification of expenses.

Omission of secondary income.

Depreciation calculation errors.

Delay in filing T2 and CO-17 forms.

Good compliance practices

Keep your accounting records up to date at all times.

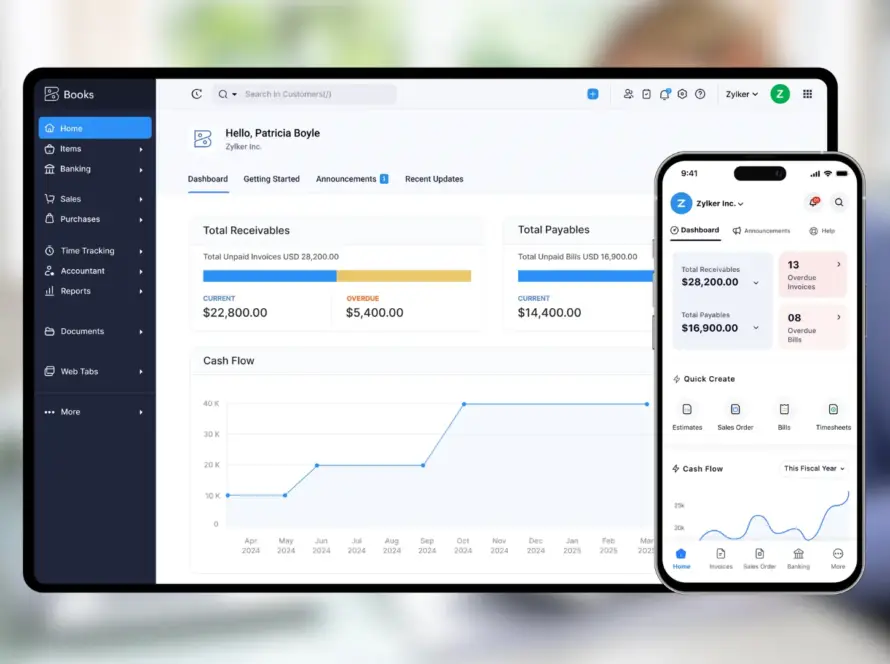

Use reliable accounting software (QuickBooks, Zoho Books).

Have your financial statements reviewed by a CPA before filing.

Keep all supporting documents for at least 6 years (required by Revenu Québec and ARC).

7. The accountant’s role in corporate tax optimization

Calling on a professional accounting firm is not an expense: it’s an investment.

Why work with a CPA?

He knows the ever-changing tax laws.

It identifies the tax deductions and credits applicable to your situation.

It helps you plan your financial decisions over several years.

It ensures compliance to avoid penalties.

A good accountant does more than just fill out forms. He or she becomes a strategic partner in your company’s growth and financial stability.

8. FAQ: everything you need to know about corporation tax

1. When do I have to file a corporate tax return in Quebec?

Generally, within six months of the end of the fiscal year. However, tax balances are due two to three months after this date, depending on the type of business.

2. What is the difference between a deductible expense and a tax credit?

A deductible expense reduces taxable income, while a tax credit directly reduces the amount of tax payable.

3. Can I file my own corporate income tax returns?

It’s possible, but not recommended without accounting training. The rules are complex and mistakes can be costly.

4. How can I legally reduce my corporation tax?

By planning ahead, maximizing eligible deductions, using available credits and adopting an optimal compensation strategy.

5. What is the difference between personal and corporate income tax?

Personal income tax applies to the income of individuals, while corporate income tax applies to the profits of incorporated companies.

Conclusion: corporate tax, an opportunity in disguise

Corporate tax isn’t just a legal obligation – it’s a performance indicator. Proactively managing your tax return means not only complying with the law, but also optimizing your company’s financial health.

Good tax planning, the right accounting tools and professional support can turn a constraint into a competitive advantage.

Need help optimizing your tax return?

TheAthmane CPA Conseils team supports Quebec entrepreneurs with customized tax strategies and efficient accounting management.