Financial management has radically changed in recent years. Gone are the days when you had to stack paper invoices in dusty filing cabinets or install bulky software on your computer. Today, online accounting is revolutionizing the way Quebec businesses manage their finances, and this change is far from being a passing trend.

If you’re a small business owner, self-employed worker, or financial manager, you’ve probably already wondered whether switching to cloud accounting was really necessary. The short answer? Absolutely. Let us explain why and how this transition could transform your professional daily life.

What exactly is online accounting?

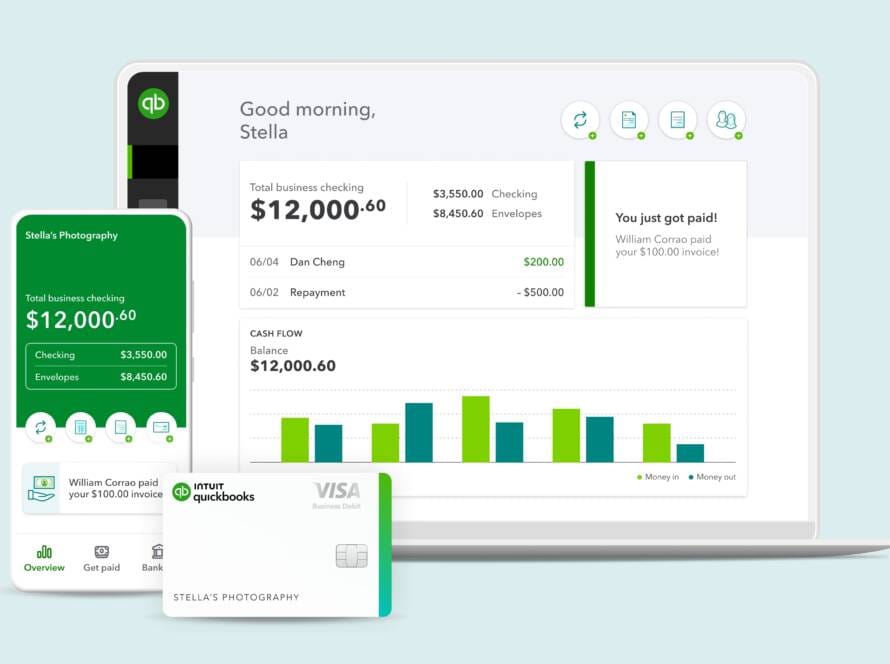

Online accounting, also called cloud accounting or cloud-based accounting, refers to the use of accounting software hosted on remote servers rather than on your local computer. Concretely, this means you access your financial data via the Internet, from anywhere and at any time.

Imagine being able to check your financial statements from your cottage in Mauricie, approve invoices in your dentist’s waiting room, or instantly share your accounting books with your accountant without having to transfer a single file. That’s exactly what cloud accounting software allows.

This technology doesn’t simply move your data to the Internet. It fundamentally transforms your approach to financial management by automating repetitive tasks, automatically synchronizing your bank accounts, and generating real-time reports. For Quebec businesses juggling GST, QST, and the specific tax requirements of our province, these tools represent considerable time savings.

The concrete benefits of online accounting software

Unprecedented accessibility and mobility

One of the greatest assets of online accounting management is its permanent availability. Whether you use a laptop, tablet, or even your smartphone, your financial data follows you everywhere. This flexibility is a complete game-changer for entrepreneurs who spend a lot of time on the road or manage their business from different locations.

I recently spoke with an online store owner who told me she saves nearly 10 hours per week since using a cloud accounting system. She can now photograph her receipts directly with her phone, and the software automatically takes care of filing and recording them in the right categories.

Simplified collaboration with your accountant

If you work with an external accountant or accounting firm, online accounting makes collaboration much easier. Your virtual accountant can directly access your books in real-time, without you having to send files by email or hand over a USB key. This immediate transparency allows for more relevant and faster advice.

During tax season, this feature becomes absolutely essential. Your professional can prepare your tax returns without interruption, ask questions directly, and finalize everything much more efficiently. Result: less stress, fewer back-and-forths, and often, a lighter professional services bill.

Enhanced security of your financial data

Contrary to what many people think, storing your accounting data in the cloud is generally much more secure than keeping it on your personal computer. Professional accounting software providers invest massively in cybersecurity: bank-level encryption, multiple automatic backups, two-factor authentication, and constant threat monitoring.

What happens if your computer breaks down, if you’re a victim of theft, or if a fire destroys your office? With SMB accounting software hosted online, your data remains intact and accessible. This peace of mind is priceless, especially when you know how valuable financial information is for a business.

Automation that frees up your time

Automation is probably the most transformative advantage of cloud accounting. The best platforms can automatically:

- Synchronize your bank transactions and categorize them intelligently

- Generate and send recurring invoices to your clients

- Send automatic payment reminders

- Calculate sales taxes (GST/QST) correctly

- Reconcile your bank accounts

- Produce customized financial reports

This automation doesn’t aim to replace human judgment, but rather to eliminate tedious tasks that prevent you from focusing on what really matters: growing your business.

How to choose the right online accounting management software

The market is full of options, and choosing the right tool can seem intimidating. Here are the essential criteria to consider for Quebec businesses.

Quebec and Canadian tax compliance

This is non-negotiable: your software must be configured to correctly handle GST and QST. Some international platforms don’t understand the subtleties of the Quebec tax system, which can cause headaches during your tax remittances.

Also ensure that the software can generate the necessary reports for Revenu Québec and the Canada Revenue Agency. A good system should facilitate the production of financial statements compliant with Canadian accounting standards.

Integrations with your other tools

Your cloud accounting solution doesn’t work in isolation. It must be able to integrate harmoniously with your other systems: e-commerce platform, payroll management software, point of sale system, project management applications, etc.

These integrations eliminate double data entry and considerably reduce the risk of errors. For example, if you use Shopify for your online store, your sales should automatically appear in your accounting system, with taxes calculated correctly and revenue attributed to the right accounts.

Intuitive interface and learning curve

Even the most powerful software is useless if no one in your company knows how to use it. Favor a clear interface, in French or English if possible, with logical navigation and easy-to-find features.

Most serious providers offer free trial periods. Take advantage of them to actually test the software with your own data, not just to watch demo videos.

Customer support and learning resources

When you encounter an urgent accounting problem, you don’t want to wait 48 hours for an answer. Check the quality of customer support: is it available in French? Can you reach someone by phone or only by email? What are the availability hours?

Learning resources also matter: video tutorials, knowledge base, webinars, user community. These elements greatly facilitate your long-term autonomy.

Best practices for a successful transition

Moving from traditional accounting to an online system requires a minimum of planning. Here’s how to ensure a smooth transition.

Prepare your historical data

Before migrating, clean up your current data. Regularize your accounts, properly close your last fiscal year, and identify which historical information you need to transfer. Most businesses don’t need to migrate more than 12 to 24 months of historical data.

Some software offers assisted import services, which can be worth the investment if you have a lot of data to transfer. Otherwise, plan a few hours to properly configure your chart of accounts and enter your opening balances.

Train your team progressively

Don’t try to change everything overnight. Identify a champion user in your team who will learn the system thoroughly and can then train others. Start with basic functions: entering invoices, recording payments, consulting reports.

Once these foundations are solid, you can gradually adopt more advanced features like reminder automation, inventory management, or cash flow projections.

Establish regular accounting routines

Online accounting facilitates daily work, but it doesn’t work miracles if you neglect your data for months. Establish weekly routines: reconcile your bank accounts, review automatically categorized transactions, send your invoices.

This regular discipline will give you a clear and up-to-date vision of your financial health, allowing you to make better-informed business decisions.

Online accounting and artificial intelligence: the future is already here

The evolution of online accounting management doesn’t stop at cloud hosting. Artificial intelligence is now transforming how these systems work.

Machine learning algorithms are becoming increasingly accurate at automatically categorizing your expenses. After a few weeks of use, your system understands your habits and can correctly classify 95% of your transactions without human intervention.

Some platforms now offer virtual assistants that can answer questions like “How much did I spend on advertising last month?” or “Which clients haven’t paid their invoices yet?”. This conversational interface makes accessing financial information much more natural.

AI-powered cash flow forecasts represent another exciting development. By analyzing your spending and revenue habits, these tools can predict your future cash flow situation with surprising accuracy, alerting you to potential problems before they occur.

Common mistakes to avoid

Even with the best SMB accounting software, certain mistakes can compromise your system’s effectiveness.

Neglecting initial configuration: Many entrepreneurs rush to start using their new software without taking the time to configure it properly. Invest a few hours at the beginning to set up your chart of accounts, taxes, expense categories, and invoice templates. This time will be largely recovered later.

Mixing personal and business expenses: Cloud accounting makes recording transactions easy, but that doesn’t mean you should mix everything. Maintain a clear separation between your personal and business finances to avoid tax nightmares.

Ignoring reports and indicators: Your software probably generates dozens of different reports, but if you never take the time to consult them, they’re useless. Identify 3 to 5 key indicators for your business (profit margin, liquidity ratio, average customer payment delay) and consult them regularly.

Forgetting human review: Automation is great, but it’s not infallible. Make it a habit to review your transactions monthly to spot categorization errors or anomalies.

How much does cloud accounting really cost?

Pricing for online accounting management software varies considerably depending on features and your business size. Here’s what you can expect:

Beginner level: Between $10 and $25 per month for basic solutions, perfect for self-employed workers and very small businesses. These packages generally include invoicing, expense tracking, and basic financial reports.

Intermediate level: Between $30 and $70 per month for more advanced features like multi-currency management, multiple users, basic inventory, and third-party integrations.

Professional level: From $80 to $200+ per month for established SMBs requiring project management, advanced reports, complex inventory, and priority support.

These costs may seem high at first glance, but put them in perspective: how much does your accountant currently cost you to manually perform tasks that software could automate? How much time do you spend each month searching for receipts, filing documents, or preparing reports? For most businesses, the return on investment materializes in just a few months.

The impact on your relationship with your accountant

A question that often comes up: “If I adopt online accounting software, do I still need an accountant?” The answer is nuanced.

A good cloud accounting system doesn’t replace the expertise of a professional accountant, but it transforms the nature of this collaboration. Your accountant spends less time on data entry and filing receipts, and can devote more energy to what really matters: tax optimization, strategic planning, and business advice.

Many modern accounting firms actively encourage their clients to adopt cloud accounting. This allows them to offer much more responsive virtual accountant services, with often more affordable fees since they gain efficiency.

Some accountants even offer monthly packages including the software subscription and a certain number of consultation hours, thus creating an ongoing partnership rather than a one-time relationship limited to tax season.

Testimonials and concrete results

Marie-Claude runs a digital marketing agency in Quebec City. Before switching to online accounting, she spent about six hours per week on her accounting and still had to send a jumble of documents to her accountant each quarter. Today, she spends less than an hour per week, and her accountant can answer her questions in real-time since he sees the same data as her.

“The aspect I appreciate most is the immediate visibility on my finances,” she explains. “I know exactly where I stand at all times. It allowed me to make better decisions, like investing in a new hire at the right time and negotiating better terms with my suppliers by clearly seeing my cash flows.”

François owns a small construction company. He and his team work on different sites simultaneously. Thanks to his online accounting software, he can track the profitability of each project individually, photograph receipts directly on-site, and invoice his clients more quickly. “I reduced my invoicing delay from three weeks to three days,” he states. “It completely changes my cash flow situation.”

Conclusion: The time to act is now

Online accounting is no longer a futuristic option reserved for large tech-savvy companies. It has become an essential tool for any business that wants to remain competitive, gain efficiency, and make decisions based on reliable and up-to-date data.

The benefits are clear: total accessibility, facilitated collaboration, intelligent automation, enhanced security, and predictable costs. The initial learning curve is largely compensated by long-term time savings and peace of mind.

If you’ve been postponing this transition for months or years, ask yourself honestly: what’s holding you back? Fear of change? Lack of time to implement a new system? The belief that your current method “works well enough”?

The reality is that each month that passes without a modern online accounting management system represents lost time, missed opportunities, and probably money left on the table. Entrepreneurs who have taken the leap unanimously testify that they wish they had done it sooner.

The good news? It’s never been easier to start. Most platforms offer free trials, assisted migrations, and support in French. You can literally create an account and start exploring today, without commitment.

As 2025 progresses rapidly, the question is no longer really whether you should adopt cloud accounting, but rather when. And what if the answer was now?

Do you want to modernize your accounting management but don’t know where to start? Consult a professional accountant who can guide you to the online accounting solution best suited to your business reality.