Bank synchronization is one of the foundations of efficient and reliable accounting. When properly configured, it allows businesses to automate transaction imports, reduce manual work, and maintain a clear, up-to-date view of their financial position. When poorly managed, however, it can lead to inconsistencies, duplicates, balance discrepancies, and reconciliation errors that are difficult to resolve.

With Zoho Books, bank synchronization is powerful, but it requires a basic understanding of accounting mechanisms and sound validation practices. This article explains how to connect Zoho Books to your bank, how to perform effective bank reconciliations, and—most importantly—how to avoid the most common mistakes that compromise accounting accuracy.

1. Why Bank Synchronization Is a Key Issue in Cloud Accounting

In an online accounting environment, the bank becomes the primary source of financial data. Bank feeds drive:

supplier payments and expenses

customer receipts

bank fees

reimbursements

cash flow movements

For this reason, bank synchronization should be treated as a structural accounting process, not merely an automatic feature.

This logic is central to cloud accounting, as explained in our analysis of cloud accounting vs traditional accounting, which shows why bank data has become the backbone of modern bookkeeping.

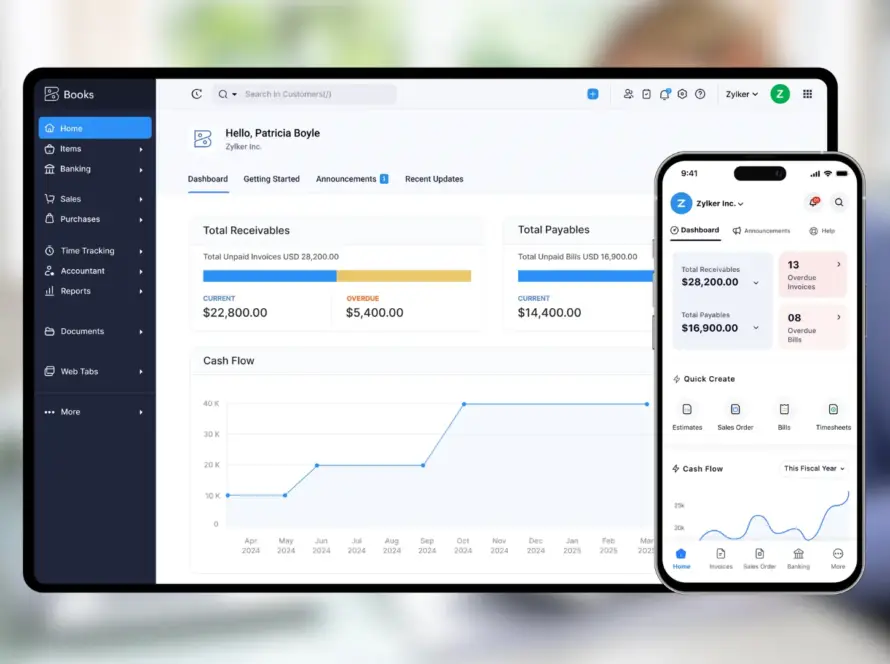

2. How Bank Synchronization Works in Zoho Books

Zoho Books bank synchronization allows you to connect your business bank accounts directly to the software in order to automatically import transactions.

In practice, Zoho Books can:

connect to most Canadian financial institutions;

import bank transactions generally every 24 hours. For some banks that require multi-factor authentication (MFA), a manual refresh may be required to update the data;

detect potential duplicate transactions;

suggest matches with existing invoices or expenses;

facilitate the bank reconciliation process.

To understand the overall logic of the platform, it is useful to consult the full overview of Zoho Books, which explains its core modules and workflows.

3. Connecting Zoho Books to Your Bank Account: Key Steps

3.1. Preparing for the Bank Connection

Before connecting a bank account, make sure that:

you are using a business account (not a personal one);

you have the required login credentials;

the account is used exclusively for business transactions;

GST/QST taxes have already been configured in Zoho Books.

Poor preparation often leads to errors from the very first data import.

3.2. Connecting the Bank Account in Zoho Books

Once inside Zoho Books, you can:

select your financial institution;

authorize secure access to transaction data;

define the start date for transaction imports;

link the bank account to the appropriate accounting account.

This step is critical for long-term reconciliation accuracy.

4. Understanding Bank Reconciliation in Zoho Books

Bank reconciliation consists of comparing:

the actual bank balance;

imported bank transactions;

accounting entries recorded in Zoho Books.

The goal is simple: ensure that every bank movement corresponds to a valid accounting entry.

Zoho Books simplifies this process by offering:

automatic matching suggestions;

categorization rules;

alerts when discrepancies are detected;

manual validation of transactions.

5. The Most Common Bank Synchronization Errors

5.1. Automatically Accepting All Transactions

One of the most common mistakes is approving all transactions without review. In reality:

some transactions may be personal;

others may be duplicates;

some represent internal transfers;

certain amounts may be misclassified.

Bank synchronization does not replace accounting judgment.

5.2. Incorrectly Matching Imported Transactions

Each bank transaction must be linked to:

a customer invoice;

a supplier expense;

a reimbursement;

an internal transfer.

Incorrect matching distorts financial reports, even if the bank balance appears correct.

5.3. Manually Adjusting Bank Balances

Manually changing a bank balance to “fix” a discrepancy is a bad practice. The issue is never the balance itself, but rather a missing or misclassified transaction.

6. Best Practices for Reliable Bank Reconciliation

6.1. Review Transactions Regularly

Ideally:

daily for businesses with high transaction volume;

weekly for smaller operations.

The longer you wait, the more errors accumulate.

6.2. Create Smart Rules

Zoho Books allows you to create rules to:

automatically classify recurring expenses;

identify specific suppliers;

assign precise accounting categories.

This improves efficiency without sacrificing control.

6.3. Clearly Separate Personal and Business Accounts

This is especially critical for self-employed professionals. This issue is addressed in detail in Zoho Books for self-employed professionals, which explains how mixing personal and business finances complicates both accounting and tax compliance.

7. Bank Synchronization and Accounting Automation

Bank synchronization is often the first step toward broader accounting automation, including:

automated invoicing;

semi-automated reconciliation;

intelligent categorization;

real-time financial reporting.

This approach is further explored in our article on how to automate invoicing and save time, which explains how to connect financial workflows to reduce manual tasks.

8. Security and Reliability of Bank Connections

Zoho Books retrieves bank transactions through bank feed service providers (such as Yodlee or Plaid, depending on the bank and region). Data is transmitted to Zoho Books using encrypted connections (SSL 256-bit).

Availability and update frequency may vary depending on the financial institution and its security requirements.

9. When Professional Support Is Recommended

Certain situations justify professional assistance:

multiple bank accounts;

multi-currency accounts;

high transaction volume;

recurring reconciliation errors;

recent migration from another accounting system.

In these cases, a properly structured Zoho Books implementation helps establish solid accounting foundations from the outset.

10. Bank Synchronization and Financial Reporting Accuracy

Accurate bank reconciliation ensures:

reliable financial reports;

a true view of cash flow;

decisions based on accurate data;

smoother collaboration with your accountant.

Poorly managed synchronization, on the other hand, renders reports unreliable—even when the software itself is robust.

Conclusion: Bank Synchronization Is Powerful—When Properly Managed

Zoho Books bank synchronization is a powerful tool for automation and efficiency. But like any powerful tool, it requires method, vigilance, and a solid understanding of accounting fundamentals.

By properly configuring bank connections, validating transactions, and performing regular reconciliations, you turn Zoho Books into a reliable financial dashboard. Used passively, however, it can quickly undermine accounting quality.

FAQ — Zoho Books Bank Synchronization

Can Zoho Books connect to all Canadian banks?

Zoho Books connects to most Canadian financial institutions. Some banks or credit unions may impose temporary restrictions due to security or MFA requirements.

How often are bank transactions imported?

Transactions are generally synchronized every 24 hours. For banks requiring enhanced authentication, manual refresh may be necessary.

Do I need to validate every transaction manually?

Yes. Automated rules help, but human validation remains essential to ensure accounting accuracy.

What should I do if the bank reconciliation does not balance?

Look for missing transactions, duplicates, or incorrect categorization. Adjusting the balance is never the solution.

Is bank synchronization secure?

Yes. Data is transmitted via encrypted connections, and access depends on each bank’s security protocols.