Advanced Accounting Expertise

Strategic Tax Optimization

A Personalized and Human-Centered Approach

Comprehensive Operational Support

Accounting firm in Laval, Montreal and throughout Quebec for SMEs and individuals

Finding an accounting firm in Laval that truly understands your needs isn’t always easy. At Athmane CPA Conseils, we support both SMEs and individuals in the day-to-day and strategic management of their finances. From accounting and taxation to financial planning, bookkeeping and tax returns, our role is to offer you reliable, customized solutions.

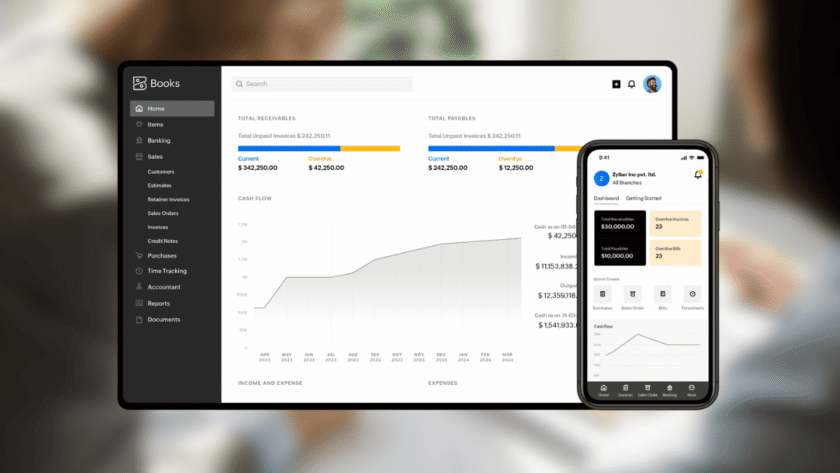

We rely on modern tools such as cloud accounting (QuickBooks and Zoho Books) to simplify your processes, reduce errors and give you a clear view of your situation in real time. With our team of experienced CPAs, you benefit from personalized support that combines rigorous accounting, tax optimization and strategic advice. Our goal is simple: to help you save time, save money and build a solid financial foundation for your personal and business projects.

We're convinced that choosing the right Laval accounting firm for your needs is the key to ensuring your company's financial health.

At Athmane CPA Conseils, an accounting firm in Laval, you benefit from the expertise of a team of CPAs and tax advisors with many years of experience. We offer a full range of services in accounting, taxation, and financial planning—designed to help you build a solid future and seize every growth opportunity.

Chartered

Accountants

Recognized Experts in Accounting and Taxation

At the core of our mission: helping you define and implement the best financial strategy, tailored to your business’ actual needs.

Don’t pay more tax than necessary. We thoroughly analyze your credits, deductions, and tax risks, anticipating the impact of each transaction to protect your interests.

Our services

“Athmane is very professional and patient. He’s helping us get started with our new accounting software (Zoho Books)! Thank you for your availability and patience!”

Anne-Sophie Gingras

Blog

How can we

help you?

FAQ

What services do we offer SMEs, self-employed workers and individuals?

We offer a full range of accounting and tax services: bookkeeping, financial statements, tax returns (T1, T2, GST/QST), tax optimization, financial planning and strategic advice. We also support our customers in implementing cloud-based accounting solutions such as QuickBooks and Zoho Books.

Why choose cloud accounting with our firm?

Cloud-based accounting lets you manage your finances in real time, reduce errors and automate routine tasks. With tools like QuickBooks and Zoho Books, we facilitate remote collaboration and simplify document sharing. You gain efficiency, security and clarity over your finances.

How much do our accounting services cost?

Our rates depend on your needs: volume of transactions, type of declarations, strategic support, etc. We offer packages tailored to SMEs, self-employed workers and individuals. Our aim is always to offer you a personalized, transparent and cost-effective service, with no surprises and no hidden costs.

What documents do I need to start working with us?

To get off to a good start, we need your recent bank statements, sales and purchase invoices, payroll records, tax returns (GST/QST), previous financial statements and access to your current accounting software, if applicable. We’ll guide you step by step to simplify the transfer and ensure a smooth transition.

Can I change accountant during the year without complications?

Yes, you can change accountants at any time. We’ll take over your files, update your data and ensure continuity of your tax obligations. Our team ensures that the transition is seamless, with no loss of information and no delay in your accounting obligations.

How can we help you reduce taxes legally?

Our CPAs identify all the deductions, tax credits and strategies that are right for you. For individuals, this means maximizing your refunds and avoiding costly mistakes. For SMEs and the self-employed, we offer proactive tax planning to reduce your tax burden and optimize the management of your income and dividends.

Do we offer remote services?

Yes, even though our accounting firm is based in Laval, we work with customers all over Quebec thanks to online accounting and secure exchanges. Our meetings can take place virtually, without compromising on the quality of our support.

Do we offer strategic consulting for SMEs?

Absolutely. We help managers analyze costs, improve profitability and plan for growth. Our consulting services cover cash management, budget planning and internal process optimization, to turn your figures into real decision-making levers.