Setting up your accounting software correctly from the start is one of the most important steps for your business’s financial health. Poor configuration can lead to tax errors, inaccurate reports, inconsistent bank reconciliations, and significant time loss for both you and your accountant.

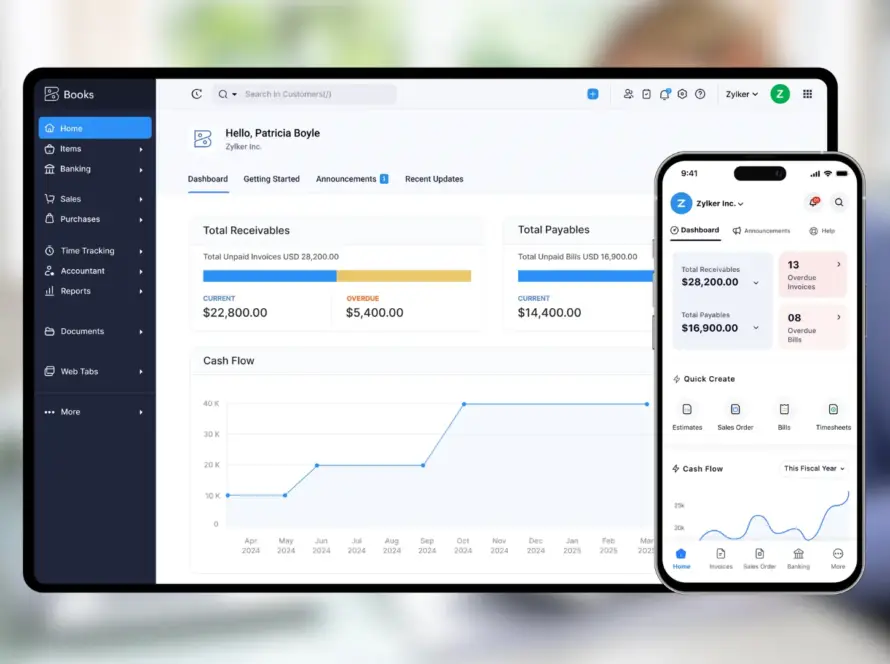

Zoho Books is known for its power and flexibility, but like any professional tool, it requires methodical setup. This Zoho Books beginner guide walks you step by step through the initial configuration, taking into account the fiscal and operational realities of Quebec-based SMEs.

1. Before You Start: Understanding the Zoho Books Logic

Zoho Books is a cloud-based accounting software built on a simple yet rigorous structure:

a structured chart of accounts;

properly configured taxes (GST/QST);

synchronized bank feeds;

categorization rules;

financial reports generated automatically from consistent data.

To fully understand the platform’s capabilities, it is helpful to start with an overview of Zoho Books, especially if you are new to cloud accounting software.

2. Creating Your Account and Entering Company Information

The first step is to create your organization in Zoho Books and enter your basic company details:

legal business name;

full address;

country and province (Quebec);

currency (CAD);

fiscal year;

business type (SME, self-employed, corporation).

These settings directly affect tax configuration, reporting, and regulatory compliance.

This step is often underestimated, yet it determines the consistency of your entire accounting setup.

3. Tax Configuration: GST and QST

3.1. Why Tax Setup Is Critical

Incorrect tax configuration is one of the most costly mistakes for Quebec businesses. Zoho Books supports proper management of GST (5%) and QST (9.975%), provided they are configured correctly from the start.

3.2. Setting Up Taxes in Zoho Books

In the tax settings, you must:

create GST and QST as separate taxes;

apply the correct rates;

link taxes to the appropriate accounting accounts;

define tax rules based on your products or services.

This structure aligns with Revenu Québec and CRA requirements when configured properly.

To understand how tax configuration fits into a broader system, you may consult our guide on online accounting in Quebec.

4. Chart of Accounts: Adapting the Structure to Your Business

4.1. The Default Chart of Accounts Is Only a Starting Point

Zoho Books provides a standard chart of accounts, aligned with common accounting practices. However, it often needs adjustments to reflect:

your industry;

your revenue streams;

your expense categories;

your reporting needs (marketing, subcontracting, admin costs, etc.).

4.2. Chart of Accounts Best Practices

avoid creating unnecessary accounts;

use clear, consistent naming;

align accounts with real tax and reporting needs;

think ahead about the reports you want to analyze.

A well-structured chart of accounts prevents complex corrections later.

5. Configuring Customers, Vendors, and Products

5.1. Customers and Vendors

Create or import:

active customers;

suppliers and vendors;

complete contact details;

payment terms;

tax settings.

This step streamlines invoicing and payment tracking.

5.2. Products and Services

Define:

products or services;

pricing;

applicable taxes;

linked revenue or expense accounts.

Accurate configuration prevents invoicing and categorization errors.

6. Bank Synchronization: Configure Without Creating Errors

Bank synchronization allows you to automatically import transactions from your bank.

Zoho Books can:

connect to most Canadian financial institutions;

import transactions generally every 24 hours (manual refresh may be required depending on the bank);

suggest matches with existing invoices or expenses.

However, incorrect configuration can lead to duplicates or reconciliation issues. This topic is covered in detail in Zoho Books and bank synchronization.

7. Expense Management and Supporting Documents

Zoho Books allows you to:

record expenses manually or via bank feeds;

upload receipts;

assign expenses to the correct accounts;

track deductible expenses.

This is particularly useful for self-employed professionals, as explained in Zoho Books for self-employed professionals.

8. User Roles and Access Permissions

You can add:

employees;

partners;

your accountant.

Zoho Books lets you define granular permissions, including:

read-only access;

editing rights;

report access;

access to sensitive settings.

This improves both security and collaboration.

9. Final Checks Before Daily Use

Before using Zoho Books on a daily basis, verify:

tax configuration;

chart of accounts;

opening balances;

bank connections;

financial reports (balance sheet, profit and loss).

These checks prevent discovering errors months later.

10. When to Get Professional Help for Initial Setup

Even though Zoho Books is user-friendly, professional support is recommended when:

your business is growing;

you have multiple bank accounts;

your tax structure is complex;

you are migrating from another accounting system;

you require precise financial reporting.

In such cases, a professional Zoho Books implementation ensures a secure and scalable setup from day one.

Conclusion: Proper Setup Ensures Reliable Accounting

This Zoho Books beginner guide shows that success depends not on the software alone, but on the quality of its initial configuration.

A well-configured system allows you to:

avoid tax errors;

generate reliable reports;

save time;

collaborate efficiently with your accountant.

Zoho Books is an excellent solution for Quebec-based SMEs—provided it is set up correctly from the start.

FAQ — Zoho Books Setup

Is Zoho Books suitable for beginners?

Yes, provided you follow a structured setup process and understand basic accounting principles.

Can I change the configuration later?

Yes, but changes to taxes or the chart of accounts may affect historical reports.

Should I configure Zoho Books myself?

It is possible, but professional guidance is recommended to avoid structural errors.

Is Zoho Books compliant with Quebec tax requirements?

Yes, when properly configured (GST, QST, and reporting).